Sample Calculations

Overview

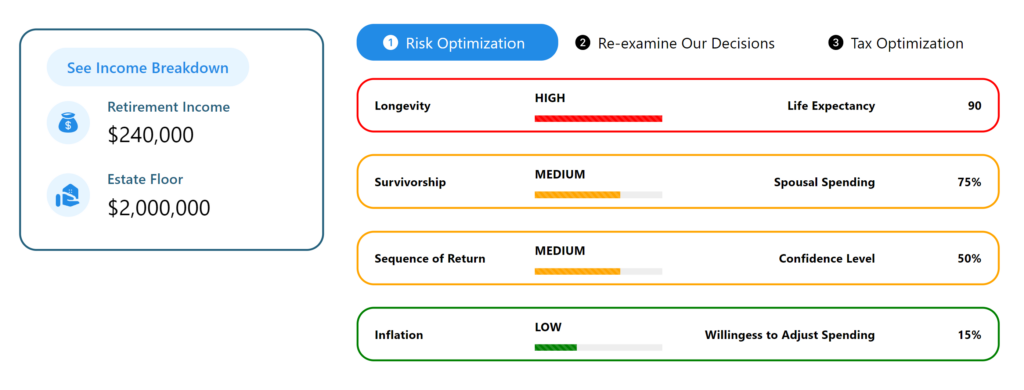

Risk Analysis

Examine and analyze different elements of particular risks that a financial plan may contain.

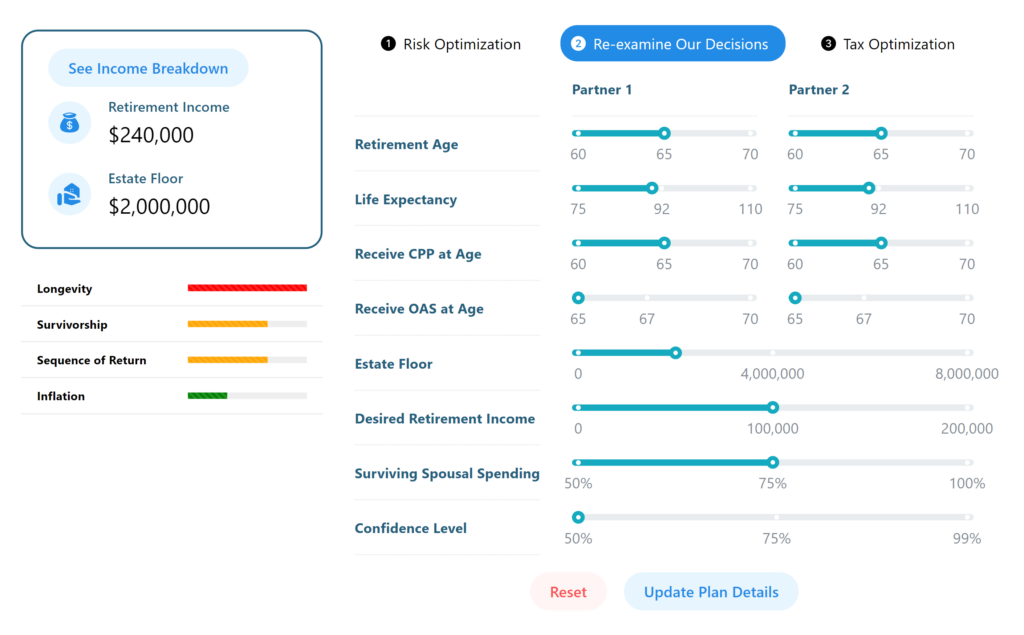

Re-examine Inputs

Advisor and client can tweak the inputs that affect estate and retirement income, and recalculate them in real-time before optimizing the financial plan.

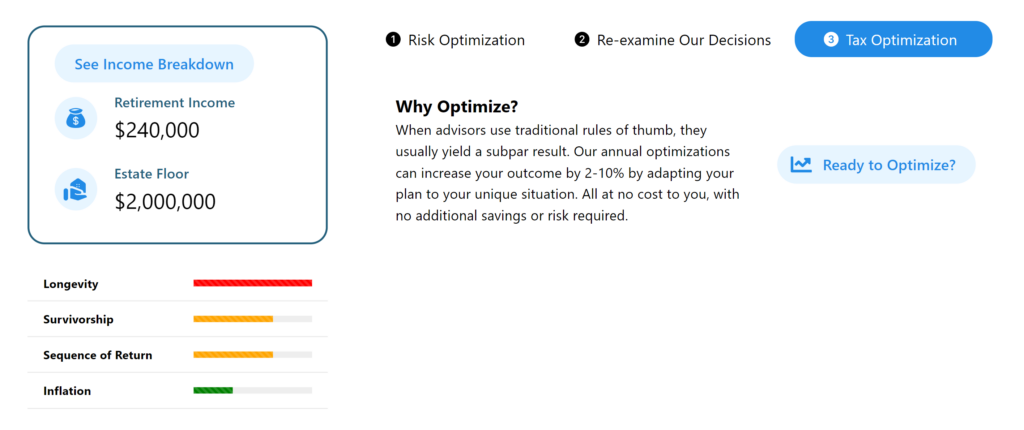

Optimize Plan

Once inputs are finalized, the advisor can then optimize the plan.

Retirement

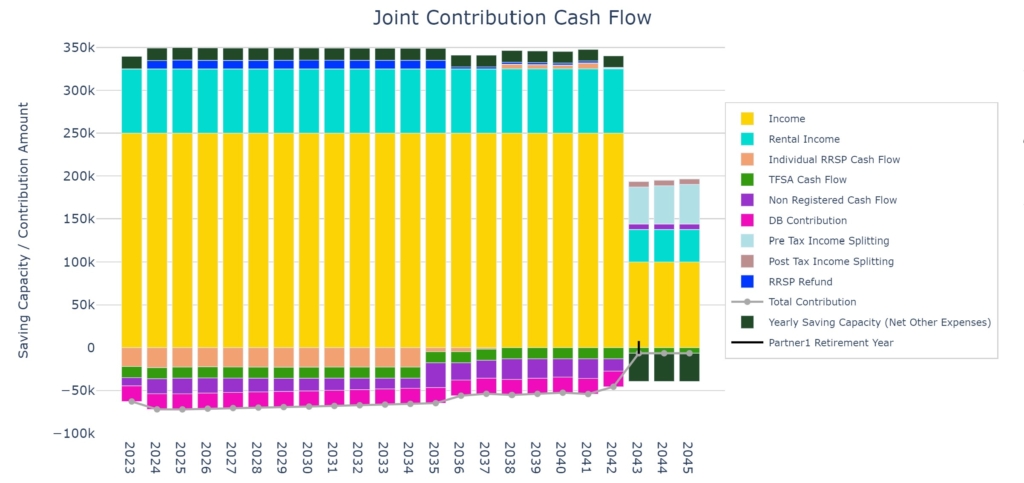

Optimal Accumulation

Optimal accumulation for couples and individual spouses calculated during working years.

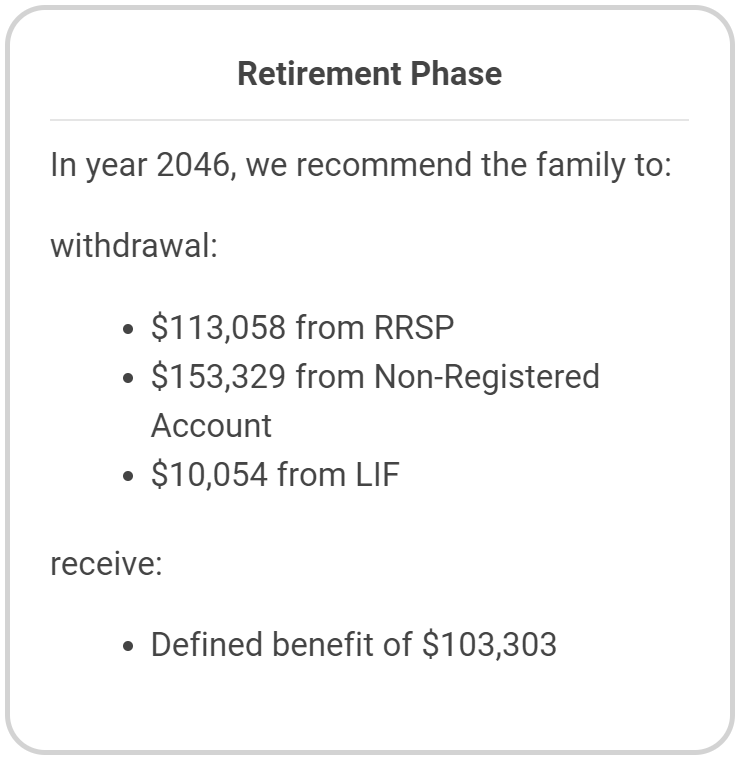

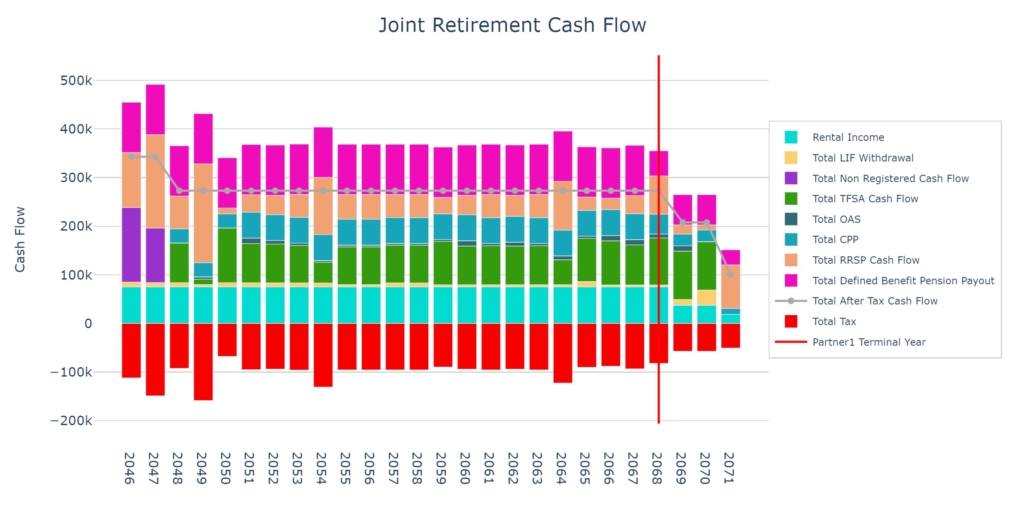

Optimal Decumulation

Optimal decumulation for couples and individual spouses calculated during retirement years.

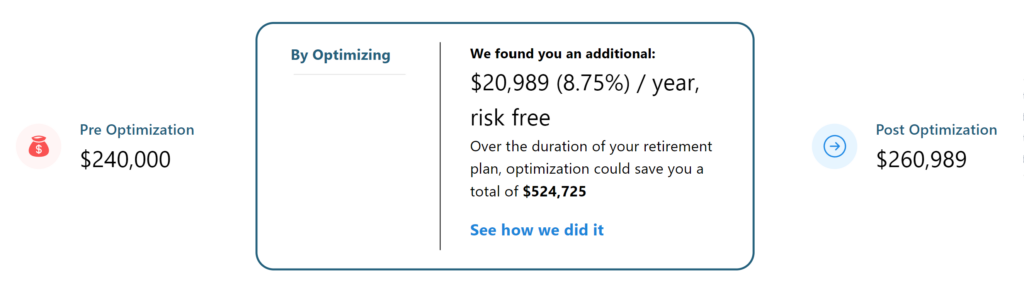

Value of Optimization

We quantify our optimal income and estate calculations versus dozens of rule-of-thumb driven strategies to quantify the value of optimization.

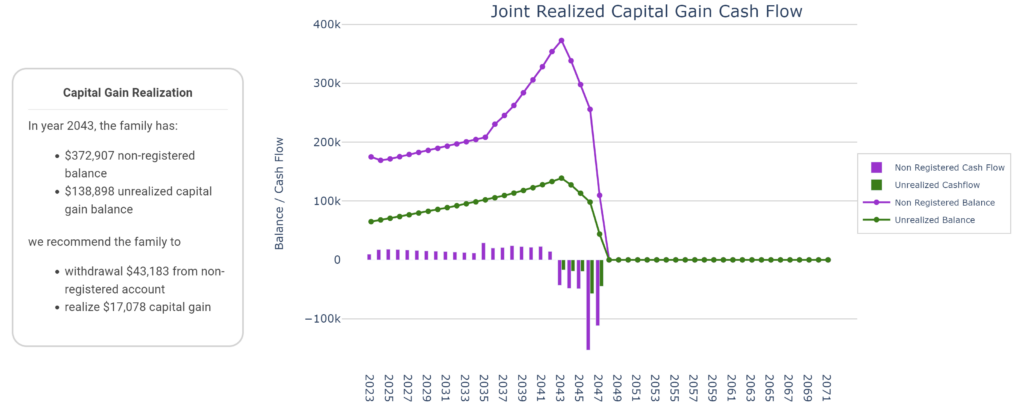

Capital Gains Realization

Optimal capital gains realization with year-by-year calls to action.

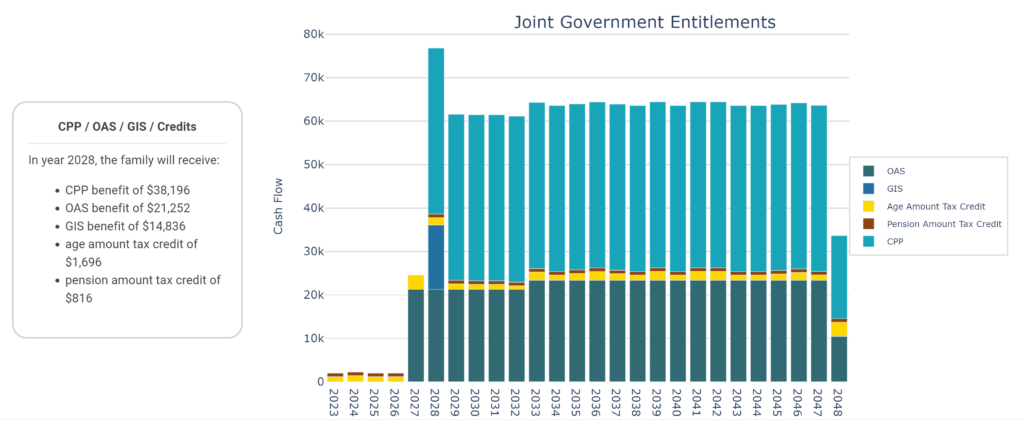

Government benefits

Entitlements

Displayed are annual CPP/QPP entitlements, OAS as well as Age and Pension Credits. GIS is also optimized when eligible.

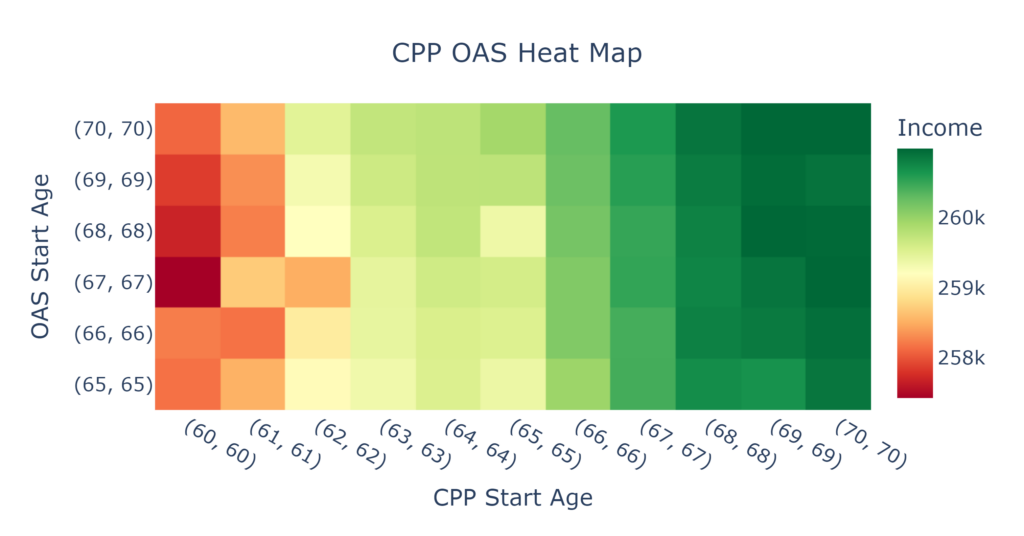

All Possible Opt-in Combinations

Optimal start dates for CPP/QPP and OAS are solved in the optimal decumulation process.

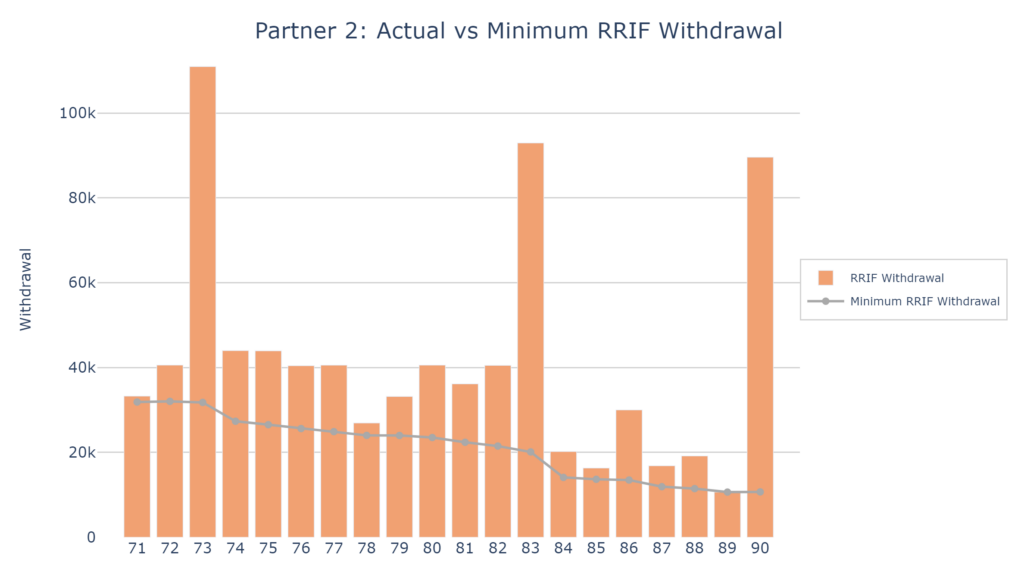

RIFF / LIF

Non Conventional Withdrawals

Optimal RRIF withdrawals are calculated. No minimum rule of thumb for withdrawal used! We tailor the strategy to maximize after-tax income and legacy to be left.

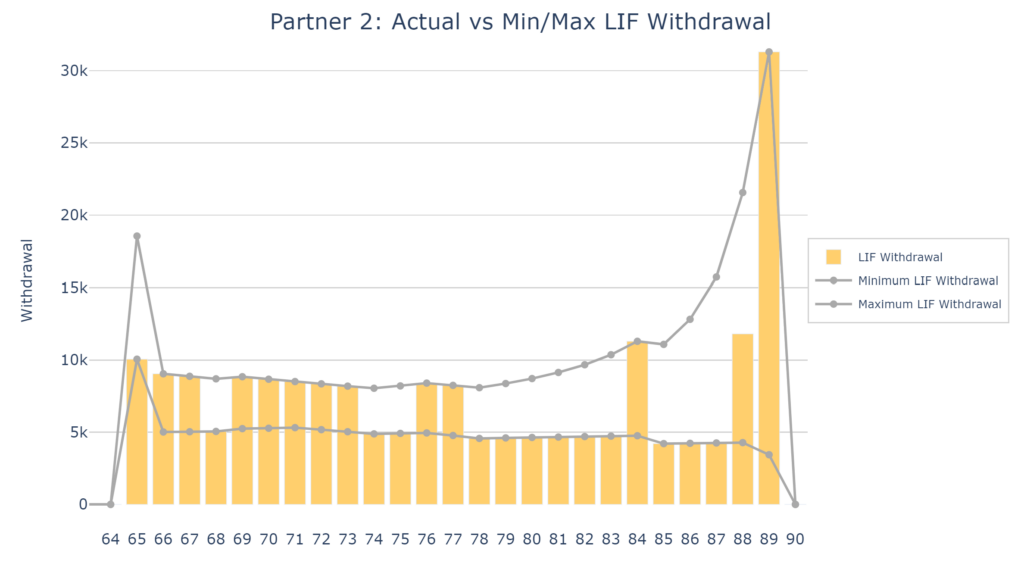

Optimal LIF Withdrawals

Deal with the particular complications arising from minimum to maximum withdrawals over the life of the plan.

Inform Clients About Their Risks

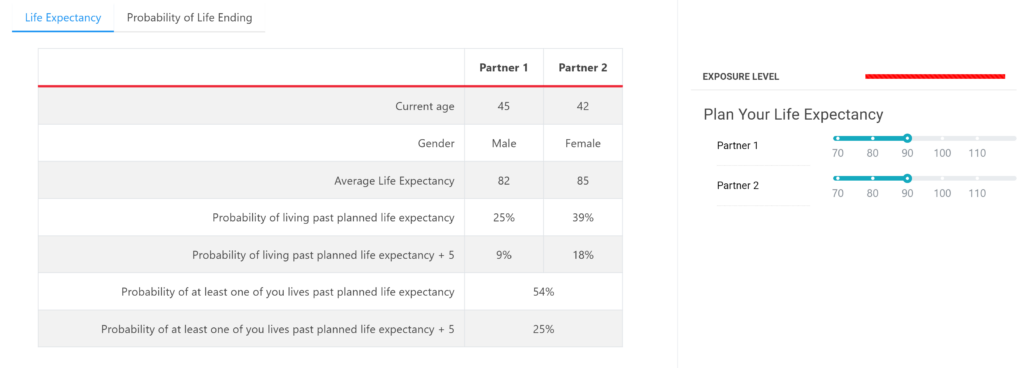

Longevity Risk

Discuss in real-time with clients the probability of outliving their assets and adjust as needed, to flow though the entire financial plan.

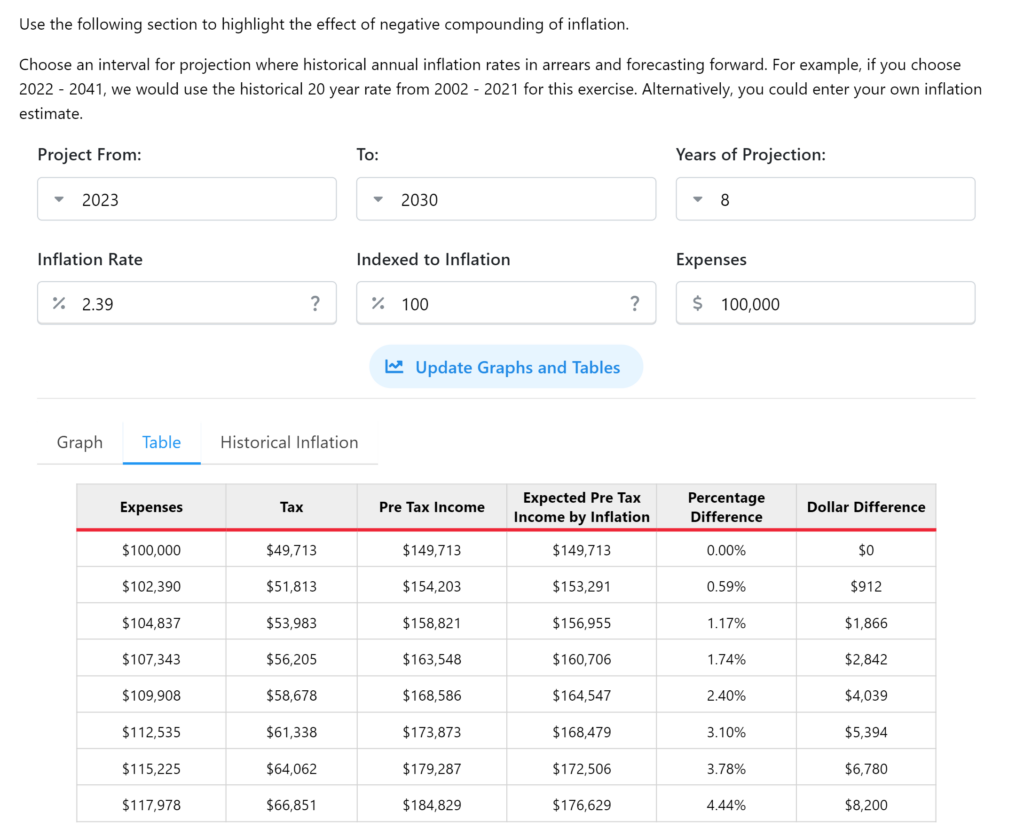

Inflation Risk

Advisors can educate their clients on how inflation can negatively impact their financial plans.

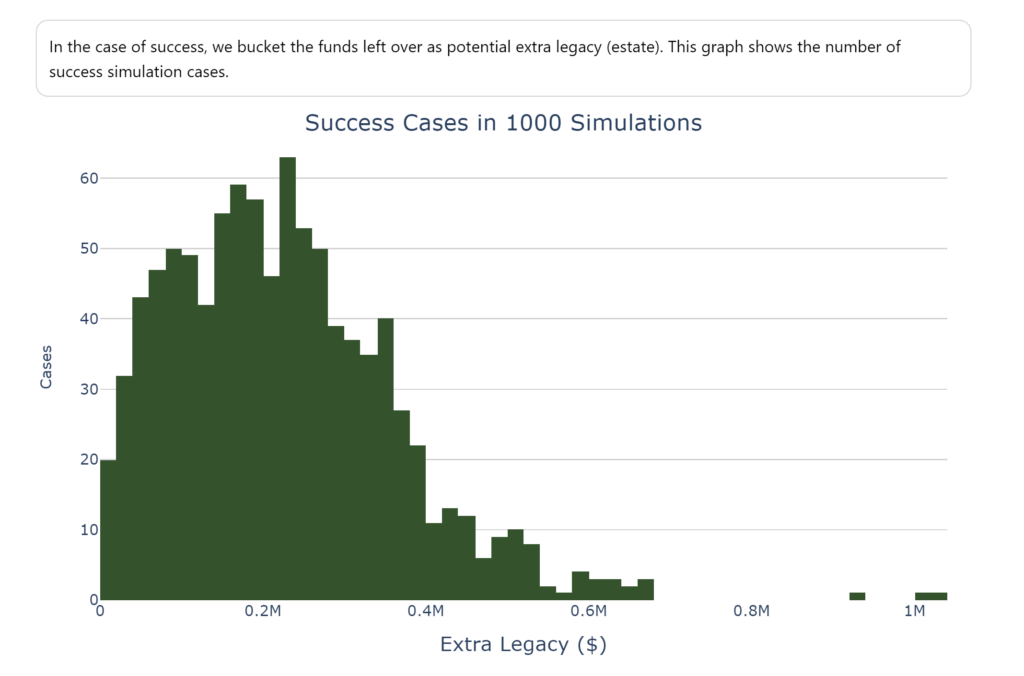

Sequence Of Returns

Discuss with clients the risk of adverse market conditions impacting retirement. Example:

“You succeeded in 95.60% of the cases, and failed in 4.40% of the cases. However, if we factor in your life expectancy (year 2056), then you succeeded in all cases because all the other failures arise because you live beyond your life expectancy, as we have planned to 2060.”

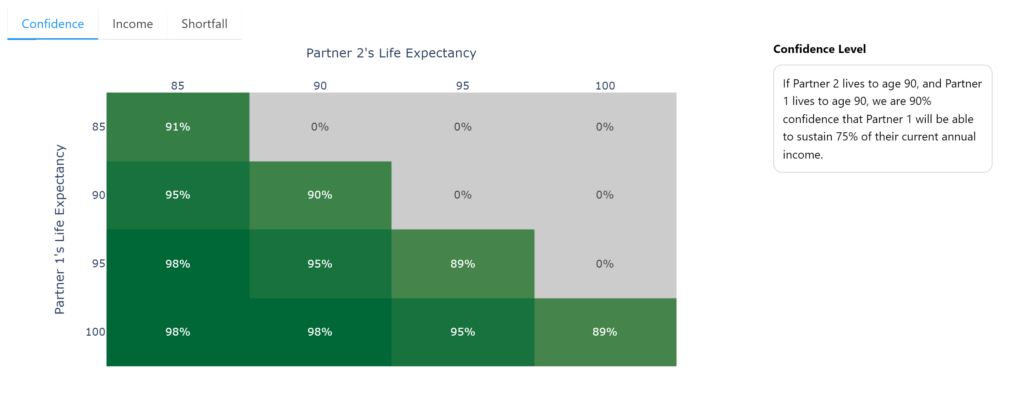

Survivorship Risk

Discuss in real-time with clients the risk of one spouse outliving the other spouse. This is done in confidence intervals, after-tax income and income shortfall.

CCPC

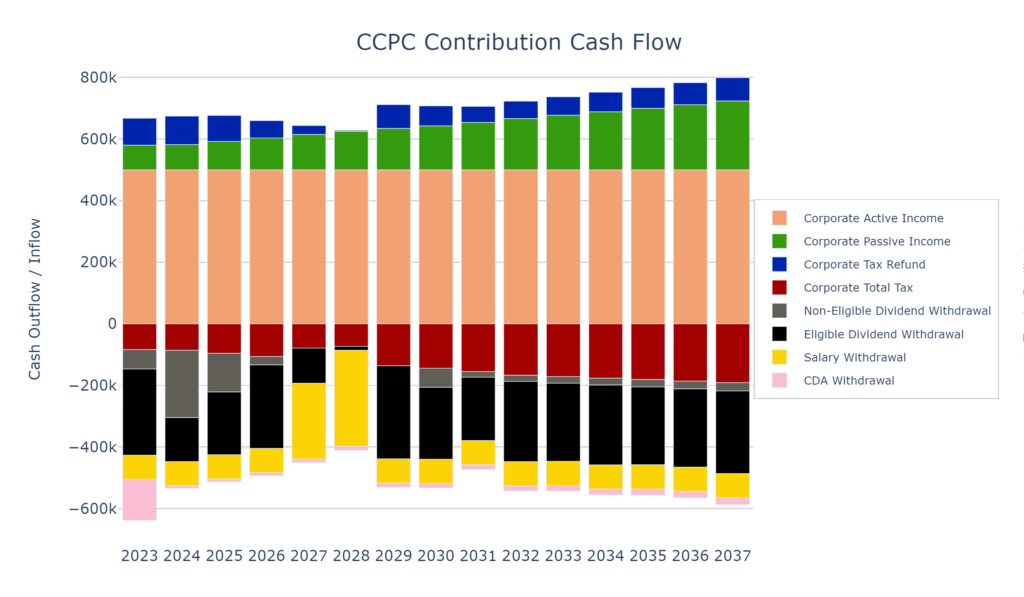

Accumulation

During working years, we capture your CCPC active income and passive income while providing an optimal withdrawal strategy from the CCPC to compensate for your annual expenses.

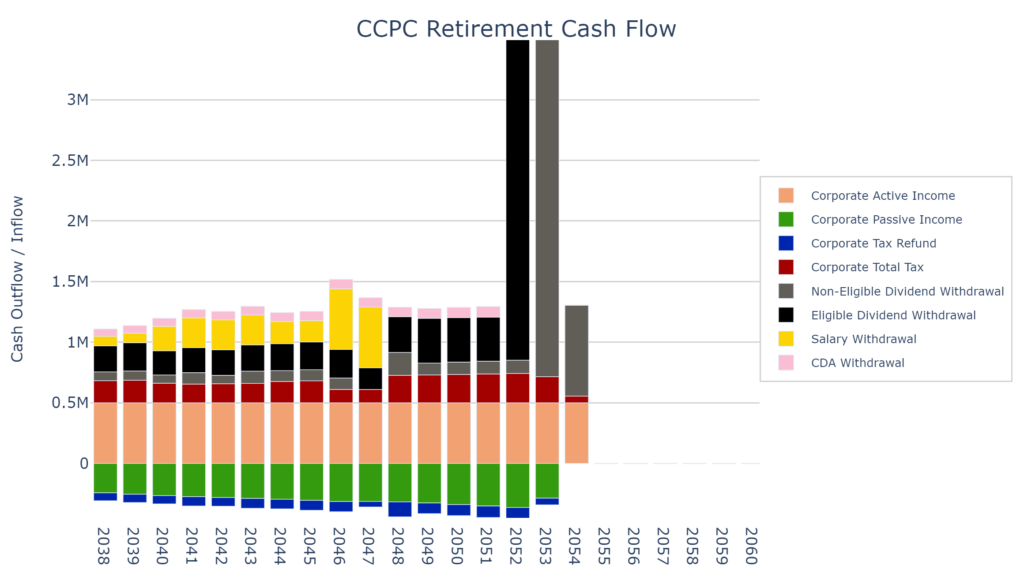

Decumulation

In retirement, we also provide an optimal withdrawal strategy to achieve your optimal retirement income and estate. You have ability to plan for the sale of the business in the future.

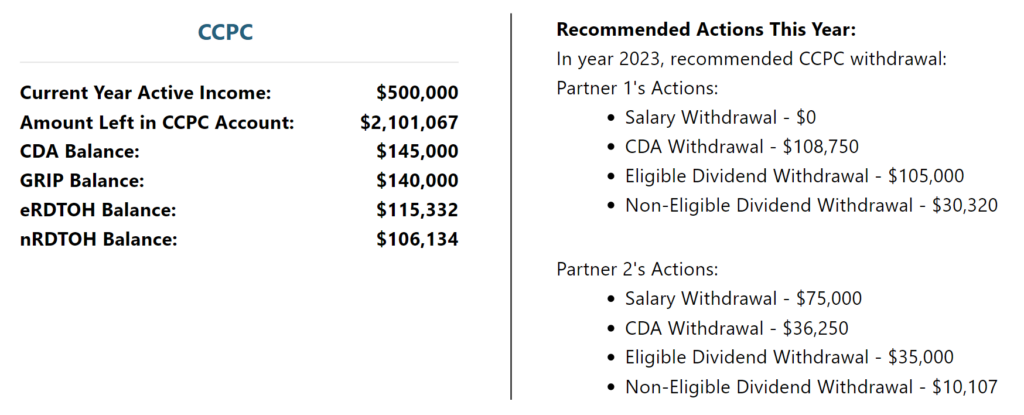

Recommended Actions

We capture all four notional accounts: CDA, GRIP, eligible RDTOH and non-eligible RDTOH, and provide an optimal withdrawal strategy from your CCPC.

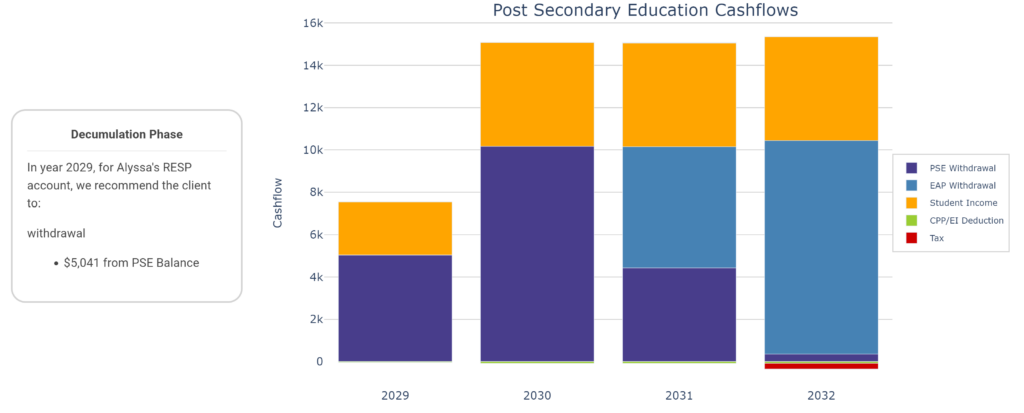

Education

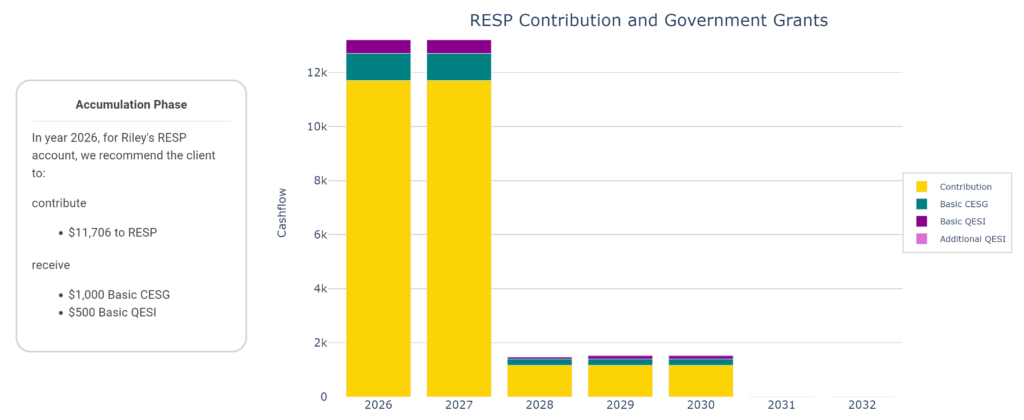

RESP Contributions

We capture CESG grants, QESI (Quebec), BCTESG (B.C), and CLB grants. We optimize RESP contributions that enable students to maximize their after-tax income to be withdrawn matching given education costs, while considering all provincial tax anomalies.

RESP Withdrawals

We breakdown the withdrawals into PSE and EAP. If not enough funds are available through RESP, the shortfall will be calculated.

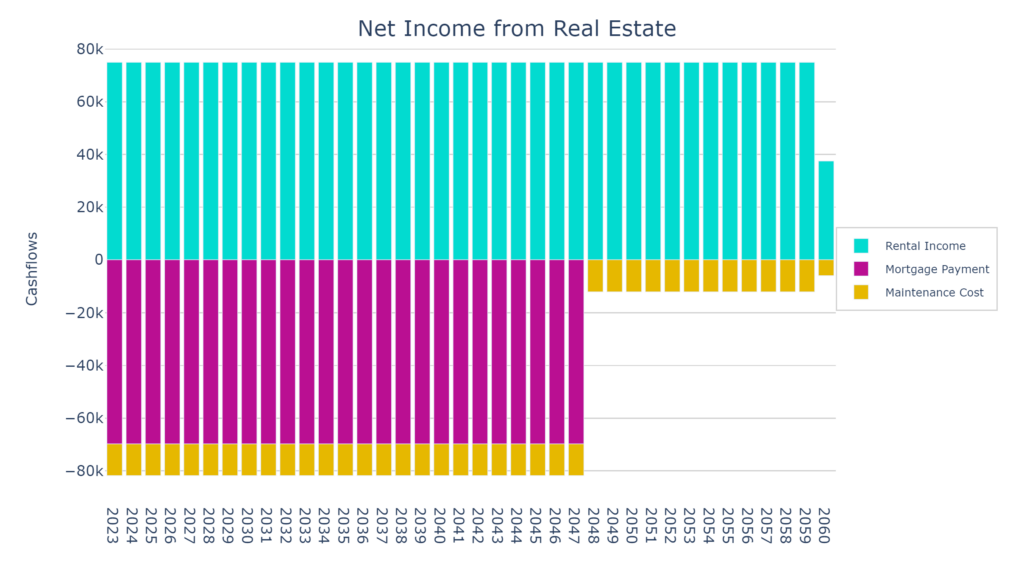

Real Estate

Net Income From Real Estate

We calculate mortgage payments, track rental incomes and costs, and relevant mortgage balances.

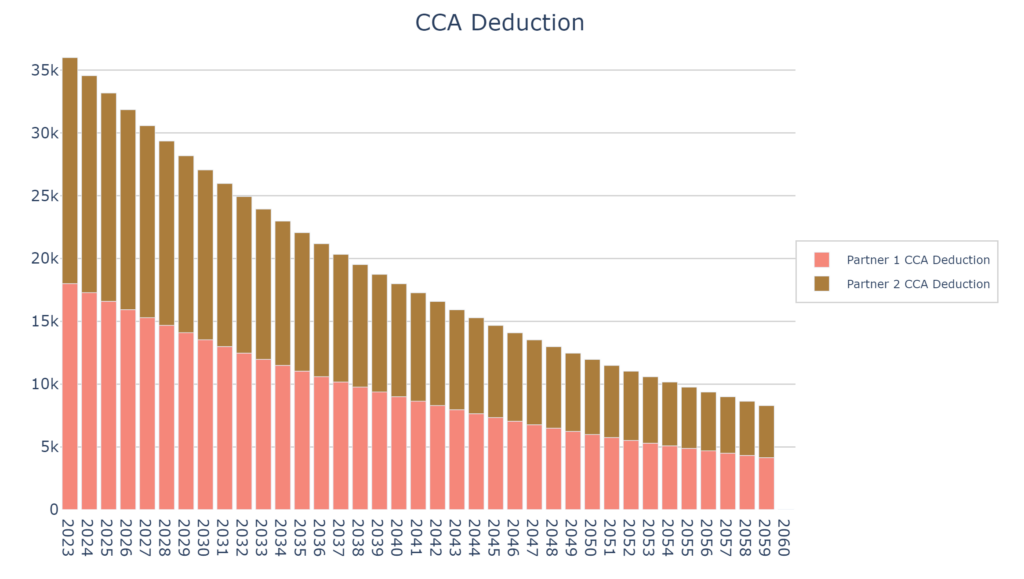

CCA Deduction

We track the amount of CCA deductions on applicable properties. In this case, this particular property is shared 50/50 between the spouses.